Separately Managed Account

Economic and Market Commentary

Equity markets experienced a broad sell-off in the third quarter, with most major indices falling for the period. While the magnitude of the decline was relatively modest, it appears that markets may finally be pricing in a number of risks and uncertainties. Higher interest rates, a stretched consumer, government funding concerns and higher oil prices are all among the issues contributing to recent weak stock market performance.

Long-term interest rates spiked higher during the quarter, taking the yield on the 10-year Treasury over 4.5%, its highest level since the financial crisis in 2008. Short rates also moved up following the FOMC decision in late July to boost the fed funds rate another 25 basis points to 5.25%; as such, the yield curve remains inverted. The fed funds rate has been raised 11 times in the last 13 meetings of the FOMC dating back to March 2022, an unprecedented series of increases. This demonstrates that Fed actions to curb inflation by jacking up its overnight interest rate have been unrelenting. The committee met again in late September, holding rates steady at that meeting, but reiterating its view that rates will need to remain “higher for longer” going forward. These actions led to a sharp stock market correction in 2022, especially for sectors with higher valuation levels such as Information Technology. Somewhat surprisingly, these same stocks have moved sharply higher in 2023, perhaps due to investor expectations that most of the Fed moves are behind us. With the Fed’s favorite inflation measure, the PCE, falling from 40-year highs last summer to around 4% today, it would appear that the heavy lifting on rates has been done. But 4% is still above the 2% Fed target, and the recent surge in crude oil prices above $90 per barrel could create additional inflationary pressures. Therefore, we tend to believe that Fed Chair Jerome Powell’s stated resolve to aggressively fight inflation is legitimate, which should indeed keep interest rates elevated for some time.

The consumer has been the main engine for the strong economic growth experienced since the Covid lockdowns. Strong consumer spending may well moderate going forward, as excess savings have been depleted and higher interest rates are impacting the housing market. Credit card balances are at record levels, however wage gains continue to be supportive of continued spending, even if moderated from recent levels. Consumer confidence remains positive, surprising given inflationary pressures, geopolitical concerns, and the well-publicized dysfunction in Washington. Regular battles in Congress to fund the government or raise the debt ceiling have unfortunately become the norm. Continuing resolutions, rather than comprehensive spending bills, are a result of the extreme partisanship we see in DC today.

Dividend and Value Environment

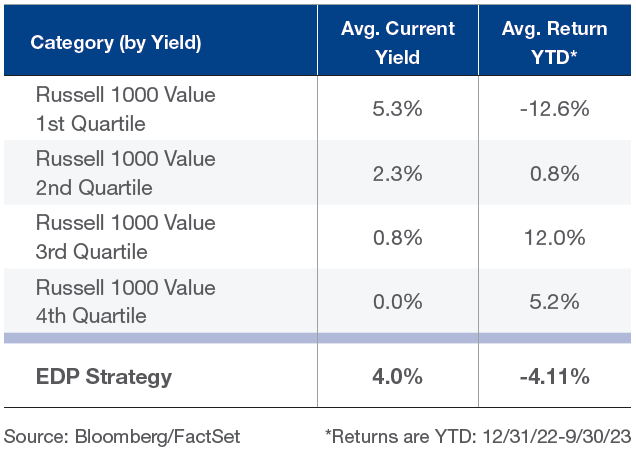

For the year-to-date period, value stocks have significantly lagged growth stocks, a complete reversal of performance trends seen in 2022 when value dramatically outperformed. And within value, above-average dividend yielding stocks were among the best performing market segments last year and the worst this year. When we break down the performance of stocks in the Russell 1000 Value by yield quartiles, the numbers are telling. The highest yielding quartile has produced dismal total return numbers this year at -12%. The other quartiles have generated positive returns. Very narrow market leadership, with only a handful of growth/technology/AI-oriented stocks leading the way, is a factor in the underperformance of higher yielding stocks, as the currently favored growth stocks pay little or no dividends. To further highlight the narrow market, equal-weighted returns for the S&P 500 YTD, which is a proxy of what the average stock has done, stand at just over 2% compared to 13% for the cap-weighted index. In this environment, portfolio returns this year have been disappointing. Following prior periods of relative underperformance, our strategy has generally seen strong results. The timing of this turn is always uncertain, but we believe, and history has shown, that consistent application of our investment disciplines results in attractive performance over full market cycles.

RUSSELL 1000 VALUE AND EDP STRATEGY RETURN ANALYSIS BY YIELD

Strategy Update

While total return numbers have been below expectations, cash flow generation from dividends and option premiums for your Equity & Dividend Plus portfolio is on pace to meet our goals for the year. Over time, the strategy has consistently delivered cash flow of 5% annually, which we expect to generate in 2023 as well. We increased our positions in International Flavor & Fragrances, Travelers and Truist Financial during the quarter. Additional portfolio activity included a reduction in our Broadcom holdings and the sale of Intel. We exited Intel primarily through call option exercises after it reduced its dividend earlier in the year and no longer met our yield targets. As discussed, it can be difficult to predict when a shift in market leadership will bring dividend paying stocks back in favor. The portfolio is very attractively valued on a historical basis, trading at only 11 times forward earnings, a significant discount to both the S&P 500 at 18 and the Russell 1000 Value at 14. We believe these valuation discounts offer relative performance opportunities in the future.

We encourage you to contact us with any questions you may have. For additional firm wide information please visit our website at www.cantor.com or call us at (855) 9-CANTOR.

Important Disclosures

The information provided herein should not be construed as a recommendation to purchase or sell any particular security or an assurance that any particular security held in a portfolio will remain in the portfolio or that a previously held security will not be repurchased. Securities discussed herein do not represent a portfolio’s entire holdings. It should not be assumed that any of the security transactions or holdings discussed herein have been or will prove to be profitable or that future investment decisions will be profitable or will equal or exceed the investment performance of the securities discussed. All recommendations/holdings within the preceding 12 months or applicable period are available upon request. Dividend income may decline during difficult economic environments if companies elect to reduce or eliminate dividends. Cash flow received via covered call option writing is highly unpredictable and may be reduced severely or completely suspended during volatile equity market conditions. The level of cash flow generated from options may vary, depending on the market value of the account. Smaller accounts, by market value, often experience less option-generated cash flow. Indices: S&P 500 is a market capitalization-weighted, total return index of widely held common stocks. Russell 1000 Value is a market capitalization-weighted, total return index of larger capitalization companies which exhibit traditional value characteristics. Indices are unmanaged and cannot accommodate direct investments. This information is intended solely to report on investment strategies as reported by Cantor FBP, the Investment Manager. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

Past performance is no guarantee of future results. As with any investment vehicle, there is always a potential for profit as well as the possibility of loss. Actual results may differ from composite returns, depending on account size, investment guidelines and/or restrictions, inception date and other factors. Nothing contained in this presentation should be construed as a recommendation to buy or sell a security or economic sector. Important Disclosures ©2023

Publication Date: 09/30/2023