Separately Managed Account

Economic and Market Review

With a strong fourth quarter rally for stocks, the S&P 500 generated well above-average returns of over 26% for 2023. Other large-cap benchmarks, such as the Russell 1000 Value, also experienced a strong fourth quarter, but full year returns were less robust than the technology-heavy S&P. It is worth noting that while the S&P outperformed the Russell for 2023, it significantly underperformed it during the bear market of 2022. Consequently, when looking at the twoyear period, returns for the S&P 500 and the Russell 1000 Value are almost identical, both up around 1.5% on an annualized basis. It is especially noteworthy that the largecap benchmarks ended the two-year period virtually the same given the extreme performance disparity between the indexes each year and given the very narrow market leadership in 2023. For example, the largest seven stocks in the S&P 500 returned 76% last year, while the other 493 stocks returned 14%, illustrating how a small number of very large companies drove the index higher.

LARGE CAP BENCHMARKS 2021 – 2023

One could argue that gyrations in the equity markets for the last two years were driven by interest rates. With inflation at 40-year highs in 2022, the Federal Reserve’s Open Market Committee, led by Jerome Powell, aggressively raised interest rates from 0% to over 5%. Higher rates in 2022 did a number on equity valuation levels, compressing price/earnings multiples, especially on the highest valued segment of the market (i.e. growth and technology stocks). Chairman Powell spent most of the last two years delivering a consistent message that he believed rates would need to remain higher for longer to whip inflation. As 2023 progressed, it became evident with each monthly inflation report that price increases were moderating. November CPI was reported at 3.1%, much lower than the 9.1% peak rate in the summer of 2022, but still marginally higher than the Fed’s stated target of 2%. Following its December meeting, the FOMC disclosed its economic projections for 2024 which revealed that committee members believe rate cuts will be on the table by midyear. This news provided further impetus for investors to buy stocks. Most analysts and economists had been predicting that the Fed would be unable to tame inflation without triggering a recession. At least at this point, it appears the Fed may have accomplished this unlikely feat.

Looking Forward

Where do markets go from here? It should be more about earnings growth and not interest rates as markets move forward. It appears that stocks may have already discounted potential interest rate cuts in 2024 with the fourth quarter rally and subsequently higher P/E ratios. Having said that, some analysts have suggested that the FOMC could cut rates as many as six times this year. If we look back at the end of 2024 and see six rate cuts, we would likely be in a very challenging economic environment, which would not be good for earnings or equity returns. If, however, we see 3 or 4 cuts this year, markets are likely to enjoy a relatively favorable environment for earnings and prices. Earning expectations were quite low when 2023 started, but improved throughout the year when it became evident a recession was not unfolding. Market leadership broadened in the fourth quarter rally as a result, and we would expect the broadening to continue this year as markets look forward to improving earnings later this year and into 2025. While it appears the Fed has navigated a soft landing, the US consumer is showing some signs of softness and employment growth seems to be slowing. The U.S. presidential election, global geopolitical instability and the potential for a Fed misstep are all factors that might break in ways that could be disruptive to the economy and markets.

Strategy Update

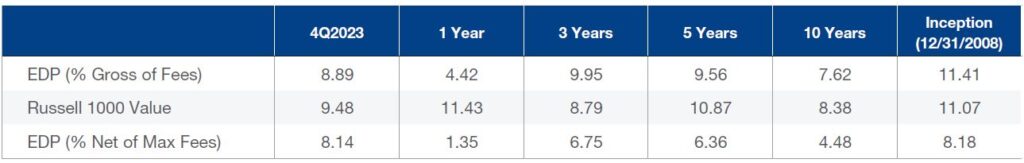

Your Equity Dividend Plus portfolio participated nicely in the fourth quarter rally. The one-year number was in line with other dividend strategies, but less than the Russell 1000 Value, after outperforming it substantially in 2022. The two-year annualized number, therefore, is on par with the benchmarks. Cash flow for 2023 generally exceeded expectations with money market returns spiking higher and option premiums coming in line with our objectives. Portfolio valuation levels remain attractive at approximately 12 times earnings, well below the forward earnings P/E of the S&P at 20 and the Russell 1000 Value at 15 times. For the quarter, we purchased Devon Energy and United Parcel Service. Devon offers well above-average dividend income potential with its last twelve months dividend yield over 6%. Company management instituted a variable dividend following Covid which is unusual for U.S. companies but has proven to be an attractive way to return cash to shareholders. This offers management flexibility to align dividend payments with current earnings. United Parcel Service stock was purchased following a sell-off related to its most recent union contract negotiations. The stock trades below market multiples and offers a yield above 4%. We sold WK Kellogg following its spinoff from Kellogg Company, which was renamed Kellanova. We also eliminated Organon from the portfolio as we became concerned about its ability to maintain its dividend at current levels.

Annualized Total Returns: Equity Dividend Plus Composite (For periods ended December 31, 2023)

We encourage you to contact us with any questions you may have. For additional firm wide information please visit our website at cantorassetmanagement.com or call us at (855) 9-CANTOR.

Important Disclosures

The strategy is managed by Cantor Fitzgerald Investment Advisors, L.P. (“CFIA”), an SEC registered investment adviser. The information provided herein should not be construed as a recommendation to purchase or sell any particular security or an assurance that any particular security held in a portfolio will remain in the portfolio or that a previously held security will not be repurchased. Securities discussed herein do not represent a portfolio’s entire holdings. It should not be assumed that any of the security transactions or holdings discussed herein have been or will prove to be profitable or that future investment decisions will be profitable or will equal or exceed the investment performance of the securities discussed. All recommendations/holdings within the preceding 12 months or applicable period are available upon request. Dividend income may decline during difficult economic environments if companies elect to reduce or eliminate dividends. Cash flow received via covered call option writing is highly unpredictable and may be reduced severely or completely suspended during volatile equity market conditions. The level of cash flow generated from options may vary, depending on the market value of the account. Smaller accounts, by market value, often experience less option-generated cash flow. Indices: S&P 500 is a market capitalization-weighted, total return index of widely held common stocks. Russell 1000 Value is a market capitalization-weighted, total return index of larger capitalization companies which exhibit traditional value characteristics. Indices are unmanaged and cannot accommodate direct investments. This information is intended solely to report on investment strategies as reported by CFIA, the Investment Manager. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

Past performance is no guarantee of future results. As with any investment vehicle, there is always a potential for profit as well as the possibility of loss. Actual results may differ from composite returns, depending on account size, investment guidelines and/or restrictions, inception date and other factors. Nothing contained in this presentation should be construed as a recommendation to buy or sell a security or economic sector.

Publication Date: 12/31/2023