QOZ Program Success to Date

Capital Raised and Community Impact

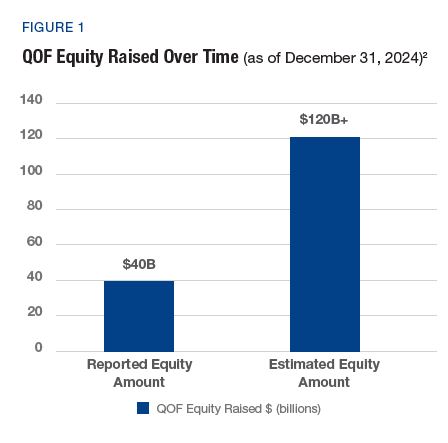

Since its inception in 2017, the QOZ Program has attracted substantial investment. In surveys, Qualified Opportunity Funds (QOFs), the investment vehicles for QOZ projects, have reported raising over $40 billion in equity as of year-end 2024. This figure represents as little as one-third of the total QOF capital raised, implying well above $120 billion in actual investment.1 This estimate far exceeds early projections, indicating strong investor appetite.

The positive economic impact of this investment is increasingly evident. QOF dollars flow directly into under served areas, financing businesses and real estate developments that increase housing supply, create jobs, and spur local economic activity. The influx of investment supports thousands of projects, from housing to business development, with tangible socio-economic benefits observed across urban and rural Opportunity Zones (OZs). It not only creates jobs but also often improves local infrastructure and quality of life.

In particular, a large share of QOF capital has been devoted to community revitalization via housing development projects. These investments are helping alleviate housing shortages by adding to new supply and sometimes provide affordable and workforce housing in many communities. Recent reports indicate that nearly 200,000 housing units have been built or are under construction through QOF investment, and that number could exceed well over 500,000 housing units when considering all QOFs.3

Outlook for Extension and Improvements: Toward “OZ 2.0”

The OZ initiative was initially championed by Sens. Tim Scott (R-SC) and Cory Booker (D-NJ). Under current law, enacted as part of the 2017 Tax Cuts and Jobs Act (TCJA), new investments in QOFs will only be accepted until December 31, 2026. However, there is growing bipartisan momentum in Washington to extend and enhance the QOZ Program, especially with key provisions of the TCJA set to expire at the end of 2025. In a press release from Sen. Booker’s office, Scott said, “Independent reporting shows that investments in Opportunity Zones are making a huge impact…with billions of dollars flowing into impoverished neighborhoods.”4

Booker and representative Ron Kind (D-WI-13) have emphasized balancing the need to extend OZs’ benefits with new guardrails to ensure the incentive truly uplifts struggling communities. There is bipartisan support for building on the success of and strengthening the program. We believe this broad backing increases the likelihood that an OZ extension and reform package will advance.5

Lawmakers from both parties recognize the successes of OZs and are working to preserve and improve the incentive. In late 2023, bicameral bills were introduced in Congress – notably the Opportunity Zones Transparency, Extension, and Improvement Act (H.R. 5761/S. 4065) – with bipartisan support.

This proposed legislation (often dubbed “OZ 2.0”) includes a suite of reforms to extend and strengthen the incentive’s impact and accountability. Key proposed enhancements include:

- Extending the OZ Investment Timeline: Shifting the deadline from December 31, 2026, to December 31, 2028, giving investors more runway to invest and preventing an abrupt drop-off in community investment.

- Transparency and Reporting Requirements: Mandating disclosure of OZ investments’ location, project type, and outcomes (e.g., jobs created). This change addresses bipartisan calls for data to ensure OZ benefits reach intended communities.

- Expanded Investment Flexibility: Allowing fund-of-funds structures and permitting some non-capital gain investments to help grow the pool of investors and capital available.

- Targeted and Zone Refinements: Focusing future OZ designations on areas of deeper economic need and rural areas with periodic redesignations.

Longer-term, Congress is exploring how to make the OZ incentive a permanent part of the tax code, with rolling deferral periods for reinvested gains. Permanency would remove the uncertainty of expirations and continually encourage reinvestment in low-income areas.

We believe the timing is favorable for legislative action. With comprehensive tax legislation expected as Congress addresses expiring TCJA provisions in 2025, OZ advocates are pushing to include an extension of the OZ incentive in that package. Within the current administration, Kevin Hassett, newly appointed director of the National Economic Council (NEC), has a track record of supporting the QOZ Program as a powerful tool for economic development and addressing the housing crisis.Scott Turner, the incoming Secretary of Housing and Urban Development (HUD), has also been vocal about QOZ incentives in many public statements.

The House’s narrow approval of a budget blueprint on February 25, 2025 marks a critical first step in shaping upcoming tax legislation. Its provisions, if passed and signed into law, lay the groundwork for extending key elements of the 2017 tax cuts, including an extension to the QOZ Program.

Given bipartisan endorsements, a positive track record, and alignment with a larger tax agenda, we believe that the QOZ Program will be extended beyond 2026. Lawmakers could enact an extension via a budget reconciliation bill (if necessary to bypass a filibuster), riding on the priority of renewing expiring tax provisions. New “OZ 2.0” provisions would aim to refine the incentive’s efficacy further while ensuring the flow of capital to communities in need continues into the next decade.

The 2025–2026 Window: A Compelling Case for QOF Investment Now

Now remains an attractive time to invest in QOFs regardless of the timing of new legislation. Two primary factors underscore this opportunity:

1. Tax-Free Growth Through the “Elimination” Benefit

Investors can still defer taxes on capital gains when they invest into a QOF, and after a 10-year holding period, any subsequent appreciation is tax-free. This “step-up in basis” effectively eliminates tax on gains accrued during the holding. An investor who rolls a $1 million gain into a QOF today would, after paying the deferred tax in 2027, realize all additional appreciation without a capital gains tax liability or being subject to depreciation recapture expense over the ten-year required investment period. This double advantage is comparable to a Roth IRA for capital gains, where the tax on compounded growth is entirely removed, bolstering long-term returns.

2. Attractive Entry Point in Commercial Real Estate (CRE)

Corrections in the CRE sector have created a compelling opportunity. Data indicates that commercial property prices fell by roughly 20% between July 2022 and March 2024.6 Early signs suggest that CRE prices may have bottomed out, with modest recovery underway.7 Multifamily assets are especially attractive due to:

- Strong Demand: The cost of home ownership has risen, making renting increasingly attractive.

- Housing Shortages: Numerous markets are experiencing major housing deficits with new housing deliveries set to materially decrease from 2024-2025 levels.

- Positive Net Operating Income (NOI) Growth Prospects: As demand outpaces supply, net operating incomes for high-quality multifamily properties are expected to grow.

Investing in a QOF now may allow investors to take advantage of these lower entry prices and be positioned for future potential NOI growth while locking in the significant tax benefits provided by the QOZ Program.

When paired with the QOZ Program’s tax-free exit provision, the current environment may offer a confluence of factors that create an attractive opportunity for investors: one can gain an entry point at lower valuations, be positioned for potential future NOI growth while allowing them to appreciate over a ten-year horizon, all without taxation on the eventual monetization of the QOF.

Conclusion

The Qualified Opportunity Zone Program has already demonstrated its effectiveness by directing billions of dollars into underserved communities, spurring economic development and job creation. With a strong legislative push toward extension and enhancement, dubbed “OZ 2.0,” the program’s future looks promising.

Moreover, now is an ideal time to consider allocating capital to QOFs. Even if new investments were to cease after 2026, the tax advantages and current attractive entry points in the CRE market make investing in Qualified Opportunity Funds during the 2025–2026 window a compelling strategy. By doing so, investors may benefit from significant tax-free growth over a decade while contributing to the revitalization of designated communities. Favorable tax treatment, strong legislative momentum, and a reset commercial real estate market create a rare confluence of conditions that makes this an opportunity not to be missed.

For additional information about the Qualified Opportunity Zone Program, visit www.cantorassetmanagement.com or contact Cantor Fitzgerald Asset Management at 855-9-CANTOR or [email protected].

1Novogradac, “QOFs Tracked by Novogradac Surpass $40 Billion in Equity at End of 2024,” February 3, 2025. (https://www.novoco.com/notes-from-novogradac/qofstracked-by-novogradac-surpass-40-billion-in-equity-at-end-of-2024)

2 See note 1 above

3 Novogradac, “New Administration Sparks Optimism Around Opportunity Zones,” February 24, 2025. (https://www.novoco.com/notes-from-novogradac/new-administration-sparks-optimism-around-opportunity-zones)

4 U.S. Senator Cory Booker, “Booker, Scott, Kind, Kelly Introduce Bipartisan, Bicameral Bill Reforming Opportunity Zones,” Press Release, April 7, 2022. (https://www.booker.senate.gov/news/press/booker-scott-kind-kelly-introduce-bipartisan-bicameral-bill-reforming-opportunity-zones)

5 See note 4 above

6 Federal Reserve Bank of St. Louis, “Commercial Real Estate in Focus,” May 30, 2024. (https://www.stlouisfed.org/on-the-economy/2024/may/commercial-real-estate-in-focus)

7 Cantor Fitzgerald Asset Management Market Observations