Artificial Intelligence (AI) has already begun to significantly impact workplaces, creative products, and society, while we are still just in the first wave of mainstream AI adoption. We believe AI is quickly becoming a new Industrial Revolution that will transform nearly every aspect of economic activity as it becomes more sophisticated, capable, and user-friendly. While much of the focus is on hyperscalers—companies committing tens of billions to data center investments—we see compelling opportunities in financing, building, and operating the critical infrastructure that underpins AI, without needing to bet on which tech giants will ultimately prevail.

The Infrastructure Gap

AI needs extensive supporting infrastructure to deliver on its potential, requiring significant investments in the construction of data centers,power generation, and transmission mechanisms for both water and power (electricity).

Even as AI becomes more efficient through decentralized, open-source models, aggregate demand continues to surge.1 This is a classic example of Jevons Paradox: greater efficiency lowers the cost of AI, accelerating adoption and ultimately increasing total consumption.This, in turn, can heighten the demand for the infrastructure required to support it—particularly power and water.

We believe this convergence of secular AI-driven demand and cyclical repricing in commercial real estate and infrastructure has created a compelling entry point. As traditional CRE markets show signs of bottoming and infrastructure capital needs balloon, opportunities are emerging across energy, logistics, and digital infrastructure.

Today’s investors can access these opportunities through a range of structures, including semi-liquid ‘40 Act funds, private funds, exchange-traded products, and direct securities. These options enable customized, risk-adjusted portfolio construction that captures both resilience and growth.

Data Center Construction

Data center need is often measured in megawatts (MW) or gigawatts (GW). But data centers also require conversions or new construction, creating the potential for CRE plays for investors. In the first six months of 2024 alone, 78 data center projects began construction ($9 billion in estimated aggregate project cost and almost 12 million square feet).2

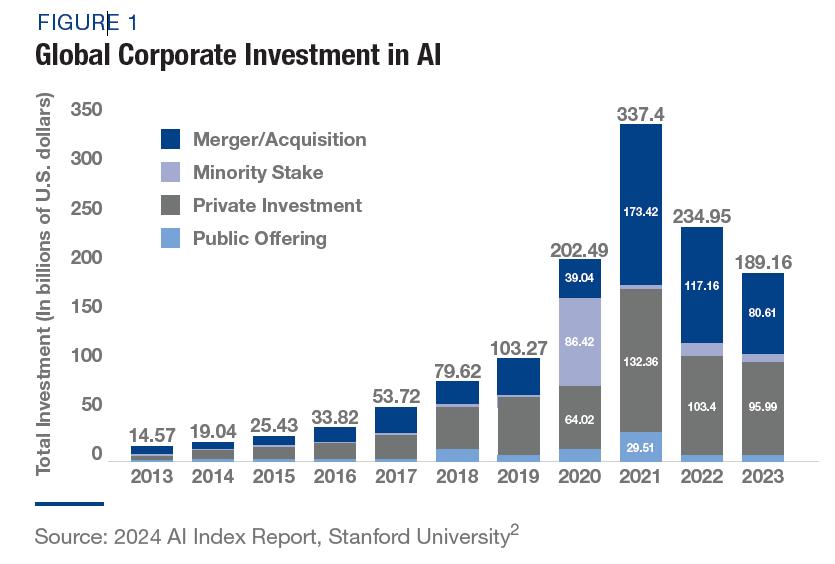

Historically, AI drove nearly $1.3 trillion in investment between 2013 and 2023.3 Over the next three to five years, large operators are expected to increase their spending on improving existing data center operations by more than 50%, as well as a six-fold increase in new construction.2

1 Stanford University, “2024 AI Index Report,” p. 242. (https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report-2024.pdf)

2 Dodge Construction Network, “The Expansion Explosion: Insights Into the Current Data Center Boom,” 4 September 2024 (https://www.construction.com/blog/the-expansionexplosion-

insights-into-the-data-center-construction-boom/)

3 Stanford University, “2024 AI Index Report,” p. 242. (https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report-2024.pdf)

AI plays a significant part in this growth. AI capabilities are driven by Large Language Models (LLMs), and training LLMs consume enormous amounts of computational power, storage, and networking capabilities. The training data set used to train models like OpenAI’s GPT-4 can consist of a petabyte of data or more, which equates to one thousand higher-end consumer one terabyte (TB) hard drives.5

Recent public announcements related to AI infrastructure investment have been staggering:

- The recently announced Stargate Project, led by Oracle, OpenAI, SoftBank and MGX, committed $500 billion of new investment in data center infrastructure over the next four years in the U.S.6

- Microsoft is on track to invest approximately $80 billion to build out AI-enabled data centers with more than half of this total investment to be in the U.S. in fiscal year 2025.7

- Social media giant Meta announced plans to spend $60 to $65 billion on capex in 2025, close to double its 2024 spend, with the primary focus on data centers and servers.8

- Global data center electricity consumption is expected to increase to around 945 terawatt-hours by 2030, according to a report by the International Energy Agency.9

- At a 24% Cumulative Average Growth Rate (CAGR) (2024-2030), AI’s total global market size could exceed $1 trillion by 2030.

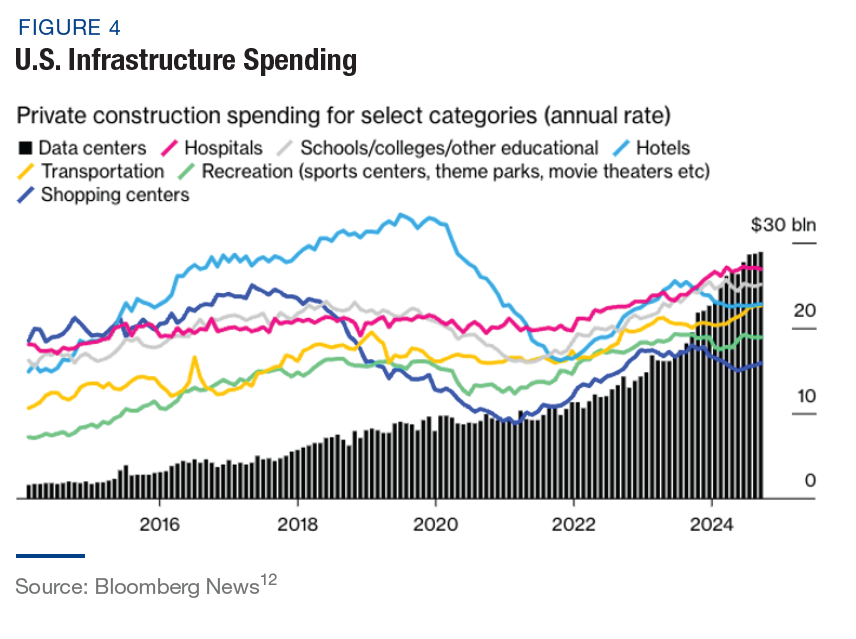

Global spending on data centers is on track to reach $250 billion a year according to KKR.11 In the U.S., investments in data centers already exceed major core categories of CRE construction, more than doubling in just two years.

4 AFCOM, “Eighth Annual State of the Data Center Industry Report Reveals How Power Design and AI Demand Has Forever Changed the Industry,” 20 February 2024 (https://www.businesswire.com/news/home/20240220636439/en/Eighth-Annual-State-of-the-Data-Center-Industry-Report-Reveals-How-Power-Design-and-AI-Demand-Has-Forever-Changed-the-Industry)

5 Deepcheck, “GPT-3.5 vs. GPT-4: Unveiling the Power of the Next-Generation Language Models,”26 June 2023. (https://www.deepchecks.com/gpt-3-5-vs-gpt-4-unveiling-the-power-of-the-next-generation-language-models)

6 AP News, “Trump highlights partnership investing $500 billion in AI.” 22 January 2025 (https://apnews.com/article/trump-ai-openai-oracle-softbank-son-altman-ellison-be261f8a8ee07a0623d4170397348c41)

7 The Golden Opportunity for American AI, January 3, 2025 (https://blogs.microsoft.com/on-the-issues/2025/01/03/the-golden-opportunity-for-american-ai/)

8 Meta plans $60-65bn capex on AI data center boom, will bring ~1GW of compute online this year (https://www.datacenterdynamics.com/en/news/meta-plans-60-65bn-capex-on-ai-data-center-boom-will-bring-1gw-of-compute-online-this-year/)

9 “Energy and AI,” International Energy Agency, 2025. (https://www.iea.org/reports/energy-and-ai/executive-summary)

10 Statista, “Artificial intelligence (AI) market size worldwide from 2020 to 2030,” November 28, 2024. (https://www.statista.com/forecasts/1474143/global-ai-market-size)

11 Bloomberg News, ”KKR Sees $250 Billion Spent Annually From Data Center Boom,“ 1 November 2024 (Subscription Required)

12 Bloomberg News, “AI Takeoff Turns Data Centers Into America’s New Building Boom,” 8 November 2024 (Subscription Required)

Power Generation and Transmission

LLMs also demand considerable amounts of electrical power, with each query drawing more than 10 times the amount of electricity needed for a Google search. Annual energy consumption for ChatGPT alone is estimated to reach 226.8 GWh, enough to power well over 20,000 U.S. homes for a year.13 Open AI’s ChatGPT is only one of many applications using LLMs, which also include Anthropic’s Claude, Google Gemini, and Perplexity’s PerplexityAI chatbot, among many others.

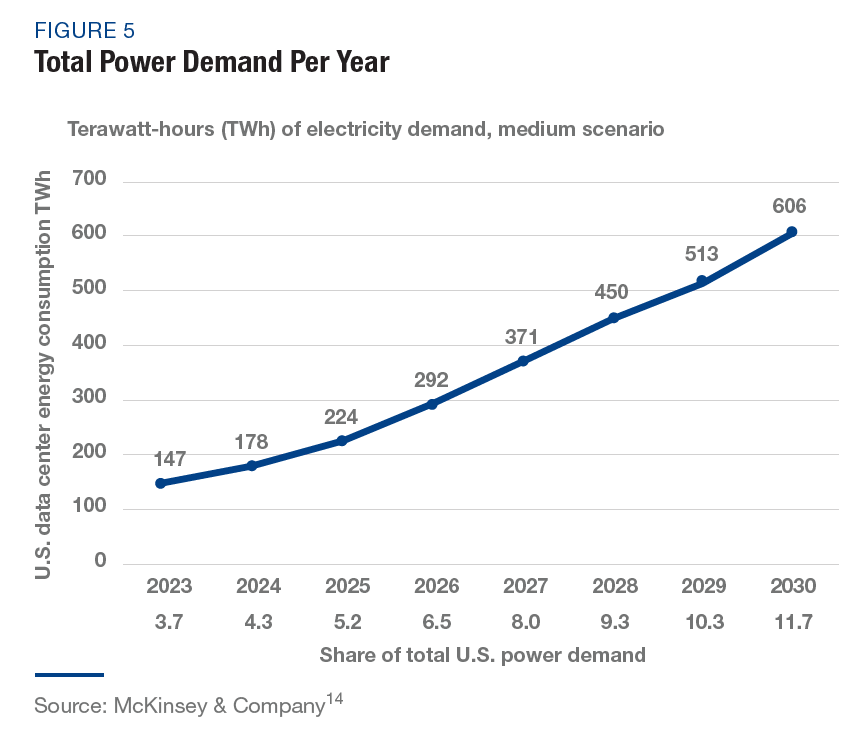

Estimates by McKinsey & Company project a more than 250% increase in U.S. electricity demand (amount of electricity used) between 2025 and 2030, even as data centers become more energy efficient. Meeting that need requires both power generation and power transmission infrastructure.

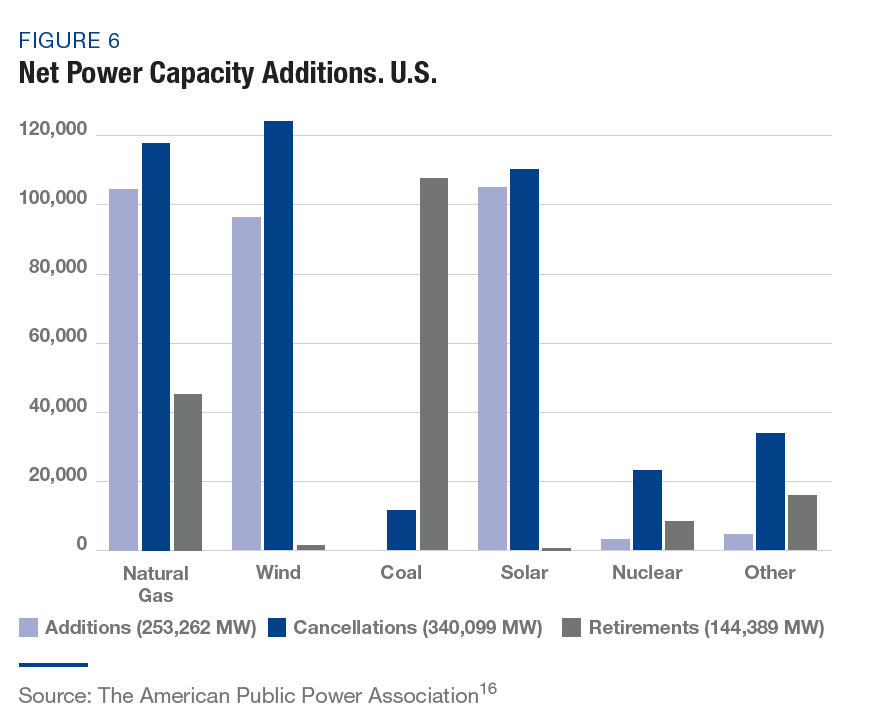

Additional McKinsey analysis projects that even if all currently known energy plants were delivered on time, there could still be a capacity deficit (the amount of power able to be generated) of more than 15 GW in the United States by 2030 as older plants go offline and new (often cleaner) plants are built to replace them.15 That figure is more than 10% of the net capacity added between 2016 and 2023. New power plants frequently take several years from project approval to going online. Tariffs may also raise the cost for U.S. renewables generation since many components are sourced from China. For these reasons, it is very probable that renewable sources alone will not suffice. Meeting extensive power demand quickly is anticipated to take tapping into nuclear, natural gas, and even coal generation, delaying plans to retire high-emissions facilities.

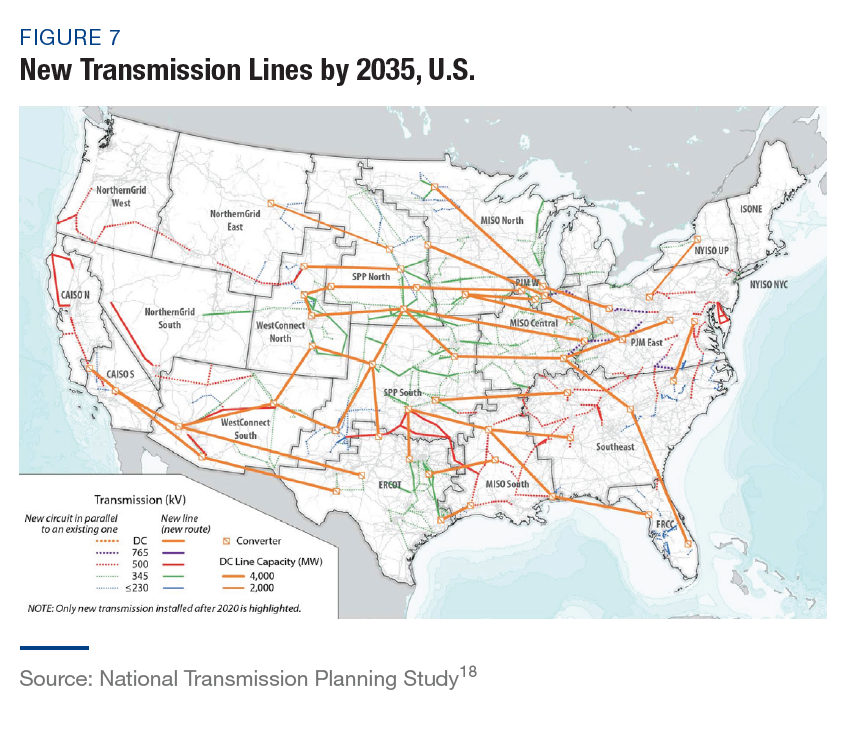

In addition to power generation, plants and data centers must be connected to the U.S. electrical grid. Doing so can be challenging when plants are built far from population centers, which is typical, especially with clean energy sources like wind and solar. Reinforcing the electrical grid in the U.S. is estimated to take more than 47,300 miles of new transmission lines between 2030 and 2035, a 57% increase from 2023.17 Data centers and the race for AI leadership are playing a notable role in these demands on the overall energy infrastructure, either by tapping into the grid or seeking direct connections to power plants.15

13 RW Digital, “How Much Energy Do Google Search and ChatGPT Use?”, 31 October 2024. (https://www.rwdigital.ca/blog/how-much-energy-do-google-search-and-chatgpt-use)

14 McKinsey & Company, “How data centers and the energy sector can sate AI’s hunger for power.” 17 September 2024 (https://www.mckinsey.com/industries/private-capital/our-insights/how-data-centers-and-the-energy-sector-can-sate-ais-hunger-for-power)

15 McKinsey & Company, “AI power: Expanding data center capacity to meet growing demand,” 29 October 2024 (https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand)

16 The American Public Power Association, “America’s Electricity Generation Capacity, 2024 Update,” April 2024, (https://www.publicpower.org/system/files/documents/Americas-Electricity-Generation-Capacity-2024.pdf)

17 U.S Department of Energy, “National Transmission Needs Study.” February 2023 (https://www.energy.gov/sites/default/files/2023-02/022423-DRAFTNeedsStudyforPublicComment.pdf)

18 National Renewable Energy Laboratory, “National Transmission Analysis Maps Next Chapter of US Grid Evolution,” 3 October 2024 (https://www.nrel.gov/news/features/2024/national-transmission-planning-study.html)

Bandwidth Availability

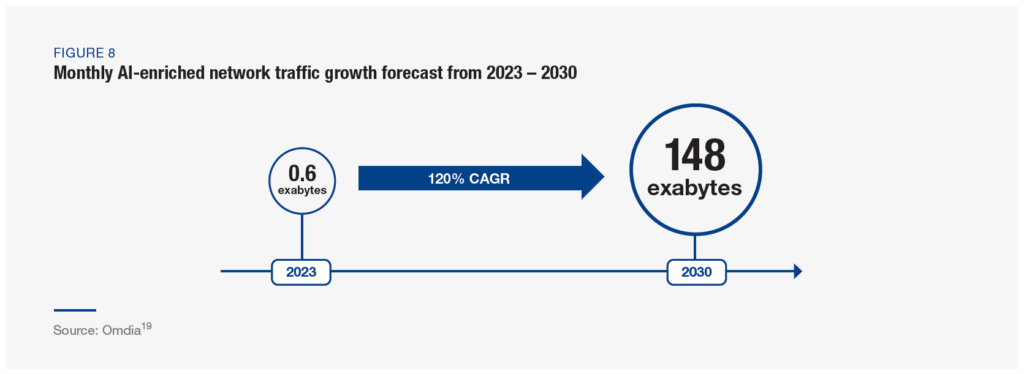

AI will likely increase demand for broadband (wired and mobile) access. Users will look for fast, low-latency access to new AI applications.

We anticipate AI will also support the adoption of other technologies, such as augmented and virtual reality, which require a high-fidelity user experience, and the Internet of Things, which requires internet access for each connected device.19

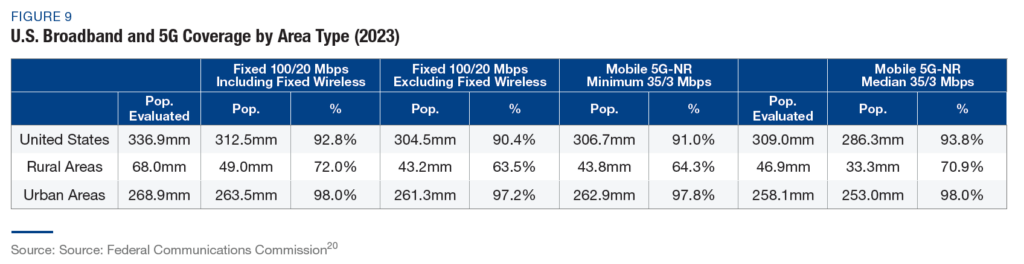

While high bandwidth fixed and mobile connections are readily available in urban areas, significant gaps in rural areas will need to readdressed. In addition, AI-powered apps could push uplink traffic beyond current 5G capacity by 2027.21

Building out a 5G mobile network in the U.S. took over $700 billion of cumulative investment between 2018 and 2023.22 While cost estimates for 6G do not yet exist, it is highly probable that full network build out, including fiber optic cables, cell towers, spectrum, edge computing facilities (which bring some of the workload closer to the end user), and maintenance, will equal or exceed 5G.

19 Cited in Ciena, “Networks will shape the future of Artificial Intelligence,” 4 August 2024. (https://www.ciena.com/insights/blog/2024/networks-will-shape-the-future-ofartificial-intelligence)

20 Federal Communications Commission, “2024 SECTION 706 REPORT,” 14 March 2024 (https://docs.fcc.gov/public/attachments/FCC-24-27A1.pdf)

21 “AI is increasing 5G traffic. Signs point toward 6G as the answer,” Fierce Network, 6 September 2024. (https://www.fierce-network.com/cloud/ai-reshaping-5g-traffic-arenetworks-ready-surge)

22 CTIA, “5G in America,” no date provided. (https://www.ctia.org/the-wireless-industry/5g-in-america)

Water

Water plays a surprising role in the infrastructure needs for AI.Both data centers and power plants place demand on access to water for cooling. U.S. demand may require between two and three billion cubic meters of water in 2027 to support AI workloads.23 ChatGPT (using OpenAI’s GPT-4 models) alone uses the equivalent of a 16-ounce water bottle to respond to complex queries of five or more questions.

While water usage may decline over time as data centers and processors become more efficient, we expect the AI revolution to create new infrastructure needs across water transport, recycling, and waste disposal.

Cybersecurity

We believe the proliferation of data, applications, servers, and technology used to support infrastructure creates a complementary investment opportunity in public or privately held cybersecurity companies. Unfortunately, AI itself will empower more bad actors to carry out more sophisticated attacks. By 2026, most advanced cyber attackers will employ AI to execute attacks that can adapt dynamically to defensive measures.25 Global cybersecurity spending is expected to grow by 33% to $272 billion between 2025 and 2030.25 This rapid growth will create enormous opportunity across cybersecurity software, hardware, and solution providers, especially innovators that can meet escalating threats from AI-enabled phishing, deepfakes, and malware.

Key Takeaways

AI, like the main actor in a film, is getting most of the attention, but real estate, energy, water, cybersecurity, and other infrastructure are the production team and supporting cast without which the film never gets made. All present compelling, often intertwined, investment opportunities which may result in a sort of gold rush. During historical gold rushes, suppliers of essential equipment prospered. With AI, financing, building, and operating critical infrastructure may offer attractive investment potential that does not require placing a bet on which AI companies will ultimately dominate.

Unlike directly investing in technology companies, these investments tap into the typical diversification benefits of infrastructure supported by the AI megatrend.

- They often aim to generate steady, predictable cash flows through long-term contracts.

- Infrastructure assets often have natural monopolistic characteristics and high barriers to entry, providing some protection against competition.

- The essential nature of these assets can provide a hedge against inflation since services remain necessary with lower dependencies on economic conditions.

The key is to focus on assets that are positioned to benefit from AI’s growing integration into the U.S. and broader global economy, the physical real estate to support the growth, and the growing energy demands required to fuel the innovation, while preserving the diversification benefits that make infrastructure attractive as an asset class.

23 OECD Policy Observatory , “How much water does AI consume? The public deserves to know,” 30 November 2023 (https://oecd.ai/en/wonk/how-much-water-does-ai-consume)

24 OECD Policy Observatory , “How much water does AI consume? The public deserves to know,” 30 November 2023 (https://oecd.ai/en/wonk/how-much-water-does-ai-consume)

25 Palo Alto Networks, ”The Convergence of Cybersecurity and AI: 7 Game-Changing Predictions for 2025,” no date. (https://www.paloaltonetworks.com/why-paloaltonetworks/

cyber-predictions)