Key Takeaways

- The Qualified Opportunity Zone (QOZ) Program is now permanent following the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025.

- The QOZ Program’s tax-free appreciation for gains on investments held for at least 10 years remains and includes freedom from depreciation recapture upon exit.

- Current CRE valuations, program permanence, and strong multifamily fundamentals create what we believe is a compelling investment environment aligned with long-term, tax-free growth.

- The 2025–2026 window represents a compelling period for investment, as certain QOZs available today may be phased out, we believe entry points in CRE are timely, and the full benefits of tax-free compounded growth and depreciation recapture remain available during this time period.

Program Permanence and Legislative Update

The OBBBA has made the QOZ Program a permanent part of the tax code, providing certainty and long-term strategic planning opportunities for investors and advisors. New qualifying census tracts will be designated every ten years, with the next designation cycle to begin on July 1, 2026. The new Opportunity Zones (OZs) will go into effect on January 1, 2027. The current OZ map will remain in effect through the end of 2028, meaning that it will overlap with the new round of designations for two years.

In addition to decennial OZ designations, key program enhancements designed to bring certainty, simplicity, and fairness include:

- Rolling five-year deferral periods (assuming a five year hold) starting for investments after December 31, 2026.

- A 10% basis step-up on deferred gains held five years.

- Continued tax-free appreciation and freedom from depreciation recapture for gains on investments held 10+ years.

- Narrowing of eligible census tracts to focus investment in areas of highest need.

- Creates Rural QOZ (RQOZs) Funds with a 30% basis step-up provision and lower substantial improvement tests.

- Enhanced reporting requirements to improve transparency and accountability for funds and investors.

QOZ Program Success to Date

Capital Raised and Community Impact

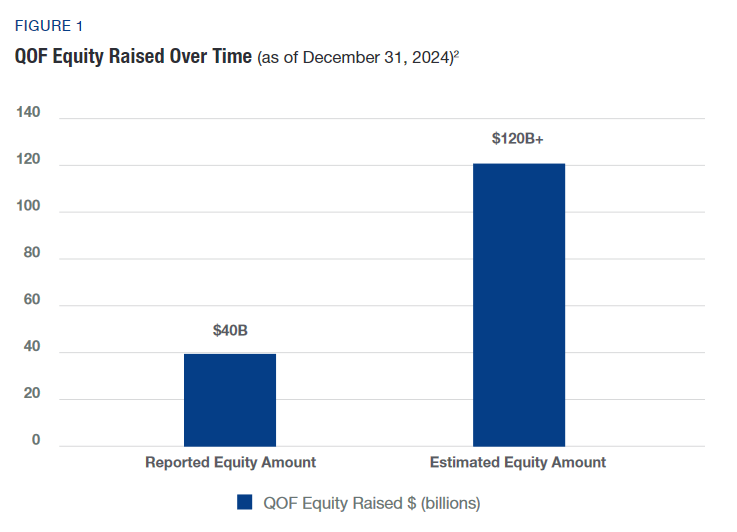

Since its inception in 2017, the QOZ Program has attracted substantial investment. As of year-end 2024, surveys of Qualified Opportunity Funds (QOFs), the primary vehicles for QOZ investments, report over $40 billion in equity raised. Since these surveys likely capture only a subset of the market, estimates of total capital deployed exceed $120 billion.1 This level of investment far surpasses early projection sand reflects sustained, strong investor demand for tax-advantaged impact-driven opportunities.

The economic impact of this capital is increasingly visible. QOF dollars flow directly into under served communities, financing businesses and real estate developments that drive job creation, housing supply, and broader local revitalization. Thousands of projects have been supported to date— spanning urban, suburban, and rural Opportunity Zones—generating tangible improvements in infrastructure, employment, and quality of life.

A particularly noteworthy area of impact is housing. Opportunity Zones have emerged as one of the most effective pro-housing supply policies in the country. According to groundbreaking research published in 2025by the Economic Innovation Group, QOF investments have already facilitated the development of over 313,000 new housing units—a figure that far exceeds earlier estimates. These neighborhoods, which had experienced virtually no new housing supply for a decade prior to the program, are now outpacing the national average in housing creation. OZs now account for 48% of all new housing built in designated tracts, 16% of all housing in low-income communities, and 4%of all new housing nationally.3

Even more striking is the program’s efficiency. The average subsidy cost per unit is just $26,000, making QOZs vastly more cost- effective than traditional housing programs.3 The study concluded that Opportunity Zones are “dominating other housing tax incentives” in both production and efficiency. This success is driven in part by the structure of the program itself—market-based and streamlined, with “by-right” qualification and minimal bureaucratic friction.

1 Novogradac Surpass $40 Billion in Equity at End of 2024,” February 3, 2025. (https://www.novoco.com/notes-from-novogradac/qofs- tracked-by-novogradac-surpass-40-billion-in-equity-at-end-of-2024)

2 See note 1 above 3 https://eig.org/opportunity-zones-housing-supply/

Investment Timing Considerations

The passage of the OBBBA has made the QOZ Program permanent, providing a stable, long-term framework for tax-efficient investing. However, we believe there are several considerations for investors to act during the 2025-2026 window:

Phasing out of QOZs

While the new program goes into effect on January 1, 2027, many existing OZs that are available today may no longer qualify under the updated eligibility criteria when the new designations take effect or government officials may not designate such tracts a second time around. Investing now allows investors to secure positions in high-quality OZs that may be phased out in 2027 while still accessing the program’s powerful tax benefits.

Potential Reduction in Deferred Gain Tax Liability

Investors committing capital to QOFs in 2025–2026, particularly those in the early stages of development, may benefit from a reduced tax bill in 2027. Because taxes on deferred gains are due that year, projects still under construction may be valued below their future stabilized levels, resulting in a lower taxable amount. This “J Curve” effect makes investing in shovel-ready or early- stage QOFs especially compelling, as it could meaningfully reduce the investor’s 2027 liability.

Tax-Free Growth Through the “Elimination” Benefit

Investments held in a QOF for at least 10 years can realize all subsequent appreciation entirely tax-free. This “step-up in basis” effectively eliminates capital gains taxes on growth during the holding period. For example, an investor who contributes $1 million to a QOF today would, after paying any applicable taxes on the original gain in 2027, benefit from tax-free treatment on all future appreciation, without being subject to depreciation recapture. This structure offers a powerful advantage, comparable to a Roth IRA for capital gains, where compounded growth is shielded from taxation, significantly enhancing long-term after-tax returns.

Attractive Entry Point in Commercial Real Estate (CRE)

Corrections in the CRE sector may have created a compelling opportunity. Data indicates that commercial property prices fell by roughly 20% between July 2022 and March 2024.4 Early signs suggest that CRE prices may have bottomed out, with modest recovery underway.5

Multifamily assets may be especially attractive due to:

- Strong Demand: The cost of home ownership has risen, making renting increasingly attractive.

- Housing Shortages: Numerous markets are experiencing major housing deficits with new housing deliveries set to materially decrease from 2024-2025 levels.

- Positive Net Operating Income (NOI) Growth Prospects: As demand outpaces supply, net operating incomes for high- quality multifamily properties are expected to grow.6

We believe investing in a QOF today offers a rare confluence of benefits: a compelling entry point into CRE at reset valuations, the potential for future NOI growth, and the ability to lock in powerful tax incentives, including tax-free appreciation and exemption from depreciation recapture, over a 10-year hold period. Taken together, these dynamics make the 2025–2026 window an unusually attractive time to commit capital to Opportunity Zone strategies.

Conclusion

The One Big Beautiful Bill Act has made the Qualified Opportunity Zone Program permanent, reinforcing its role in long-term, tax- efficient investing and community revitalization. While the program’s permanence provides clarity, we believe the current environment presents a timely opportunity to consider new investments.

The next 18 months may offer a favorable window to invest in high-quality zones that could change after 2027, alongside what we view as attractive entry points in CRE markets. Allocating capital during this period may help investors access the full range of benefits—such as tax-free compounded growth and depreciation recapture—while also contributing to the development of under served communities. Strengthened by the OBBBA, the QOZ Program represents a convergence of policy support and market potential.

For additional information about the Qualified Opportunity Zone Program, visit www.cantorassetmanagement.com or contact Cantor Fitzgerald Asset Management at 855-9-CANTOR or [email protected].

4 Federal Reserve Bank of St. Louis, “Commercial Real Estate in Focus,” May 30, 2024. (https://www.stlouisfed.org/on-the-economy/2024/may/commercial-real-estate-in-focus)

5 Cantor Fitzgerald Asset Management Market Observations

6 Freddie Mac 2025 Multifamily Outlook https://mf.freddiemac.com/docs/2025_multifamily_outlook.pdf